Giving insurance brokers a better way of conducting risk analysis and communicating it to their business clients

Brief

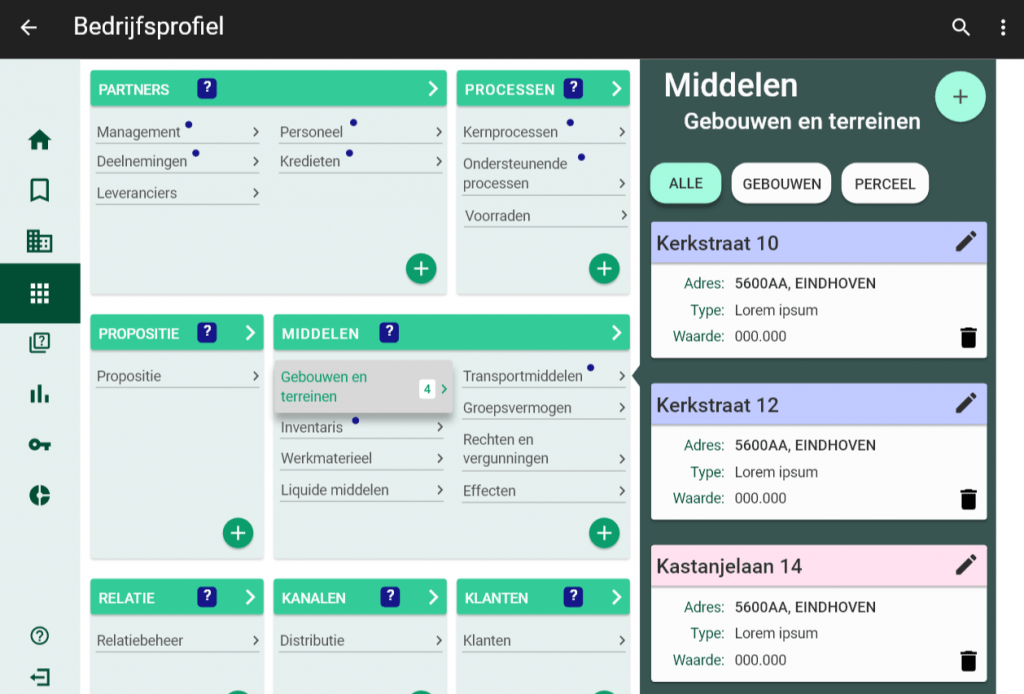

The goal of the project was to create a new tool for insurance brokers. Namely, in order for them to handle and document business risk analysis.

Approach

Firstly, we analyzed the current workflow of advisors and saw the correlations between that and the new proposed methodology based on the Business model canvas (BMC).

Secondly, we determined the bottlenecks and possible situation where users experienced high to low frustrations. Particularly the situations they had to communicate to different sources to gather data. Additionally, the analysis of coverages and relevant insurance packages.

Methods used

Process

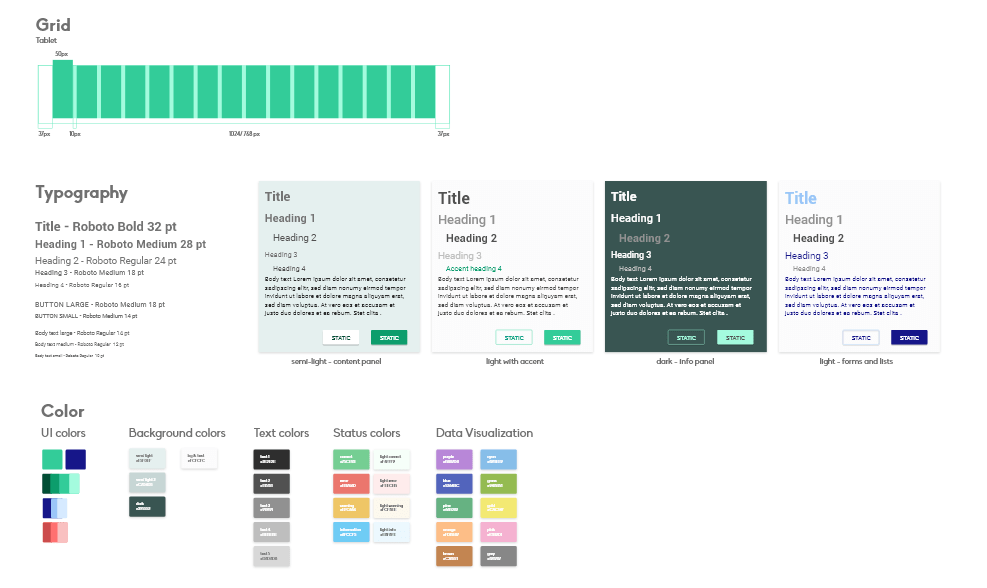

Consequently, we used an iterative process where a low-fidelity (with internal team) and high-fidelity (with external volunteers) prototypes were used to conduct user tests and establish the core insights about the risk analysis process.

Challenges

Insurance brokers focus on coverage and insurance packages which resulted in a learning frustration until they understood the BMC. For this reason tree testing and card sorting helped to create a structure of the Company profile. Namely, it matched both types of stakeholders’ expectations.

Outcome

An analysis based on initial company data which leads users through a series of filtering steps and provides a list of insurance recommendations (first phase) and concrete insurance products (second phase) to brokers. Additionally, an onboarding flow was designed to help first-time users.